Revenue & expenditure

Research platform for monitoring forest processes. Image – John Hunt

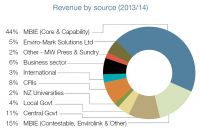

Where our revenue comes from

- Ministry of Business, Innovation and Employment’s (MBIE) Science + Innovation Group Core funding 44% – includes capability funding to maintain existing skill and to develop new science capability

- Manaaki Whenua Press & sundry 2% – Manaaki Whenua Press is our natural history and science book publishing and retailing business centre

- Business sector 6% – principally contracted work for businesses and industry organisations

- New Zealand universities 2% – contracted services, some paid lecturing by our staff, and rentals for university staff located in our buildings

- Local government 4% – contracted work for regional, district and city councils

- Central government 11% – services contracted by government departments including DOC, MfE and MPI

- Enviro-Mark Solutions 4% – which provides certification services for greenhouse gas emissions reduction and mitigation

- CRIs 8% – research subcontracted to us in collaborative programmes

- International 1% – development projects funded by donor agencies, international consultancy projects

- MBIE contestable funding sources 15%

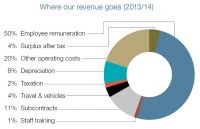

Where our revenue goes

- Employee remuneration 50% – includes staff in management, science, support roles, business development and Enviro-Mark Solutions

- Staff training 1% – includes conferences, training courses and support for postgraduate study (2.49% of the total payroll)

- Other operating costs 20% – includes electricity, carbon credits, software licences, insurance, consumables, and lease costs

- Travel & vehicles 4% – all vehicle and air travel by our staff, including the cost of leased vehicles. Landcare Research runs a mixed fleet of vehicles including 4WD and quad bikes for fieldwork, and cars and vans for road use

- Subcontracts 11% – research subcontracted to other research providers, including CRIs and universities in collaborative research programmes

- Depreciation 8% – includes accounting depreciation on buildings, science equipment and computers

- Taxation 2%

- Surplus after tax 4%